Foreword by the President and the CEO

2024 marked the 10-year anniversary of SSF, a milestone that brought with it a year of celebration and widespread praise. The highlight of our anniversary was undoubtedly the 10-year anniversary event, where we had the privilege of hosting esteemed speakers such as Mary Robinson, Kirsten Schuijt, Peter Wuffli, and many more. Together, we engaged in meaningful discussions about the need for a just transition to a low-carbon world, debated how to combine private and public wealth to enable change, explored the role of data in driving this change, and painted a compelling picture of sustainable finance over the next decade. As a special feature, we further published in our newsletter a series of interviews with 10 SSF companions, who provided invaluable insights into the remarkable developments in sustainable finance over the past ten years. These conversations also highlighted the key challenges that lie ahead, reminding us of the ongoing journey we must undertake.

However, the past year was not just about celebrations. It was also a year of significant shifts. Sustainability and ESG topics are increasingly facing headwinds, with the regulatory complexity increasing and organizations often viewing these topics solely as a burden rather than also as an opportunity. At SSF, we see it as our mandate to help our members navigate through these complex times. Our goal is to provide guidance, prepare compelling arguments for sustainable finance, and help educate organisations on the importance and benefits of sustainability.

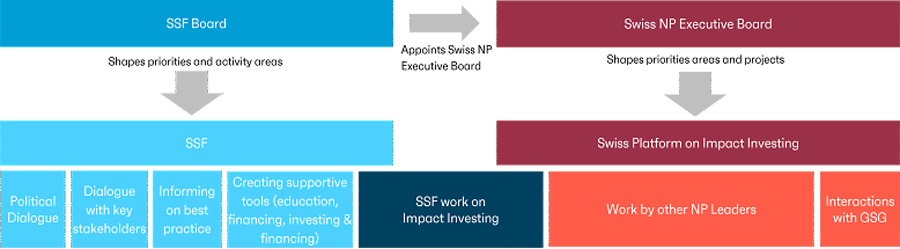

Looking forward, it is crucial to focus on the impact of our actions. To this end, we established the Swiss Platform for Impact Investing (SPII) in the past year. With its own Executive Board and various SPII Leaders, the platform leverages the expertise and network of a diverse group of impact experts. The objective is to promote impact investing in Switzerland, channeling more funds into investments that contribute to achieving the sustainable development goals – an ever more critical objective in times of multiple crises.

On a more personal note, we had to bid farewell to two long-standing members of our team: Alberto Stival, Ticino Representative and Director of Education, and Kelly Hess, Director of Projects. We extend our heartfelt thanks to both of them for their unwavering support since SSF’s inception and wish them all the best in their future endeavours. At the same time, SSF is delighted to build on a dynamic development and welcome both new team and Board members, supporting the organisation in strengthening our voice in the Swiss financial center around all aspects of sustainable finance.

Patrick Odier

SSF President

Sabine Döbeli

SSF CEO

SSF Strategic Priorities in the Year 2024

SSF has 4 strategic priorities, which it enacts through 10 activity fields.

SSF Strategic Priorities

Informing on best practice

Activity 1: Sustainable finance information

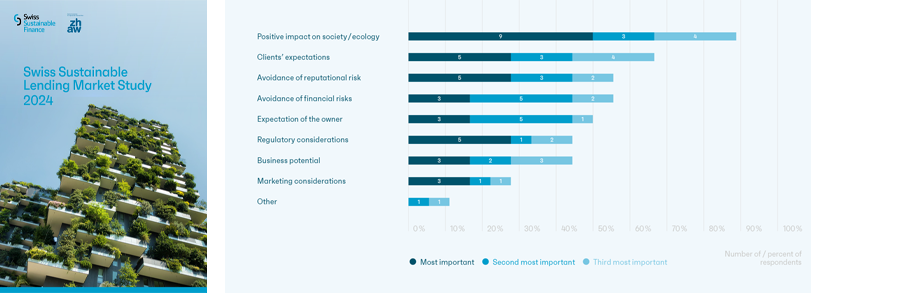

For more information see Market Study 2024 website.

For more information see Market Study 2024 website.

1st

Edition of this encompassing study on sustainability practices in the lending business in Switzerland

25

participating banks accounting for 72% of Swiss lending market

72%

of survey participants have a sustainability strategy for their lending business

2

launch events held in Zurich and Geneva

9

main motives for sustainable lending activities

For more information see Swiss Sustainable Lending Market Study 2024.

1other publication released by SSF with Tameo as valued partner throughout 2024.

A Stocktake of Swiss Impact Investing.

SSF publishes a monthly newsletter, which anyone can subscribe to. There is an additional “Inside SSF” newsletter available for members.

As 2024 was our anniversary year, we also featured an interview series with 10 SSF companions over the course of the year.

10

editions of the SSF public newsletter published

8

editions of “Inside SSF” (SSF member newsletter) published

10

Interviews in the series “Insights from 10 SSF Companions”

1

Interview with Sabine Döbeli, SSF CEO outlining how SSF started

16'025followers on LinkedIn*

SSF has considerably expanded traction on LinkedIn and thereby gained a lot of new followers.

*As of 7.1.2025

7 media releases published

- 13 March 2024: Swiss Sustainable Finance welcomes its 250th member

- 15 May 2024: First market study on sustainable lending by Swiss Sustainable Finance and the ZHAW School of Management and Law – Sustainable loans as a catalyst for the green transition

- 6 June 2024: "Swiss Sustainable Investment Market Study 2024" by Swiss Sustainable Finance: Growth lags behind market development

- 21 june 2024: "Swiss Sustainable Finance (SSF) celebrates its 10th anniversary in Bern – five new mem-bers elected to the Board of Directors"

- 27 August 2024: Swiss Sustainable Finance creates a standardised basis for comparing the sustainability of real estate funds

- 29 October 2024: Switzerland among the world's top 3 financial centres in terms of managed impact investments in private markets

- 12 December 2024: SSF launches new Swiss Platform for Impact Investing

286news items (or more) with reference to SSF, including articles by NZZ, Finanz und Wirtschaft, Le Temps, L’Agéfi, programs by SRF (Swiss radio and television) and various online platforms. 4 podcasts featured Sabine Döbeli, SSF CEO. Patrick Odier, SSF President and Alberto Stival, Director and Representative Ticino

View here

Activity 2: Sustainable finance events

Creating supportive tools

SSF bundles its activities to create supportive tools to different member types into four member platforms. For each of these platforms, two annual meetings are held to inform about key activities and lead a dialogue with members about future needs. Each platform is supported by different focus groups. Read about the various activities of the four platforms and different focus groups below.

Activity 3: Sustainable Finance Education

SSF revised and updated its “Introduction to Sustainable Investing” to integrate the new insights and data.

1revised and updated e-learning providing an introduction to sustainable investments specifically for all finance professionals.

961users registered (*)

594users received certificate (new feature from 2023) (*)

*As of 07.01.2025: https://ssfacademy.learnworlds.com/author/userprogress

Activity 4: Sustainable Investing

This annual, reoccurring focus group serves as a sounding board for changes to SSF’s annual survey which serves as the basis for our flagship publication on sustainable investments. SSF and focus group members debate and approve the market study survey, helping SSF’s survey evolve with the constantly changing industry to capture the most important market data related to sustainable investing.

1

Sustainable Investment Market Study 2024 published

>220attendants to the launch webinar

This focus group aimed to promote further adoption of investments with impact by identifying key issues related to definitions, frameworks, impact measurement and reporting. During 2024 it helped SSF understand the needs of the Swiss ecosystem. This work culminated in the launch of the Swiss Platform for Impact Investing (SPII) at Building Bridges 2024. The SPII is hosted at SSF, SSF will also provide the secretariat for the SPII and manage individual projects going forward. With the launch of the SPII the Impact Investing Focus Group was ended.

>30people helped shape inputs to the creation of the SPII

13members of the SPII Executive Board nominated by SSF Board

1launch event with over 50 participants

Find more information about the SPII here.

This focus group acts as sounding board for the SSF Secretariat in preparing founded and practical input around topics of regulation.

12meetings held in 2024

4SSF responses to public consultations submitted

1statement on the Federal Council’s new FINMA Circular “Nature-related financial risks”

SSF and GCNSL are co-conveners of the Swiss Consultation Group (CG) to the TNFD. The role of the Swiss TNFD CG is to build knowledge and capacity of the TNFD within their network. The Swiss TNFD CG consists of SSF members, GCNSL members and Swiss TNFD Forum members.

1public webinar held in 2024

4TNFD Exchange Group sessions held in 2024

35representatives of companies and financial institutions represented in the TNFD Exchange group

11speakers from across the Exchange group sessions in 2024

Activity 5: Sustainable Financing

Activity 6: Institutional Asset Owners

Shaping Swiss frameworks

Activity 7: Political Dialogue

SSF has a Board Committee on Political Dialogue in place, which defines the positions of SSF on a range of political questions.

4consultation responses prepared

7Political Dialogue Board Committee Meetings held

SSF CEO Sabine Döbeli is a member of the Advisory Committee on International Cooperation, a committee consulting the Swiss government on international cooperation and humanitarian aid. In this committee she brings in the view of the finance sector.

1Parliamentary event held

In September 2024, SSF organised a parliamentary event on the role of finance for the transition to net-zero. In the discussion with parliamentarians SSF provided insights on the levers and limitations of finance in supporting the transition to a low-carbon economy.

Activity 8: Collaboration with finance associations

SSF is in a regular dialogue with SBA on key developments in sustainable finance and the two associatons have organised a joint event on nature risks in mortgage portfolios in 2024.

Furthermore, SSF is in a regular exchange with other finance associations such as Sustainable Finance Geneva (SFG), the Swiss Insurance Association, the Swiss Pension Fund Associaton (ASIP) or CFA Switzerland Society.

Engaging key stakeholders

Activity 9: Dialogue with Representatives of the Swiss Economy

1joint workgroup with an association representing all sectors

SSF is a member of the TNFD Forum and co-hosts the Swiss Consultation Group for the TNFD along with GCNSL. See the section on Swiss TNFD Consultation Group for more information on our activities.

Activity 10: Collaboration and Exchange with International Peers

- SSF is a member of Eurosif and participates in their policy and sustainability-related investment work prepared by this pan-European body uniting national sustainable finance organisations.

- SSF hosts the Swiss Platform for Impact Investing (SPII), the Swiss National Partner to the Global Steering Group for Impact Investing, thereby partnering with this international organisation.

- SSF represents Zurich in the UN-convened Financial Centres for Sustainability (FC4S)

SSF as an organisation

SSF members and network partners

At the end of 2024, SSF was supported by a total of 263 organisations (232 members and 31 network partners), which reflects a growth of 7% compared to the previous year. See the member profiles on the SSF website.

SSF Board

The SSF Board has 15 members representing different member types and regions. In 2024, SSF elected five new members to the SSF Board. Patrick Odier is serving his third year as President of SSF. View the profiles of the current board members on the SSF website and below.